You have a business idea. You wish to bring a company into existence and get the business going. One of the most important elements required to set up the whole thing is capital. Most companies are typically incorporated with capital put in by the founders or the founders’ family and friends. This is the first round of funding that comes into the company. Hence it is often referred to as the friends and family round or the incorporation round.

As the company grows and starts acquiring a larger market share or customer base, it becomes necessary for the company to raise more capital to meet its growing business objectives. Internal sources of funding can no longer be relied upon to meet these expenses. You start looking out for investors who can help you in your journey to grow the company. The best way to do that is through fundraising. These funds can be raised from a single investor or multiple investors depending on the size and the nature of the fund. The stage of the company also plays a role in choosing the investors. Investors can be Angel investors, Venture capitalists, incubators, accelerators among others to raise funds.

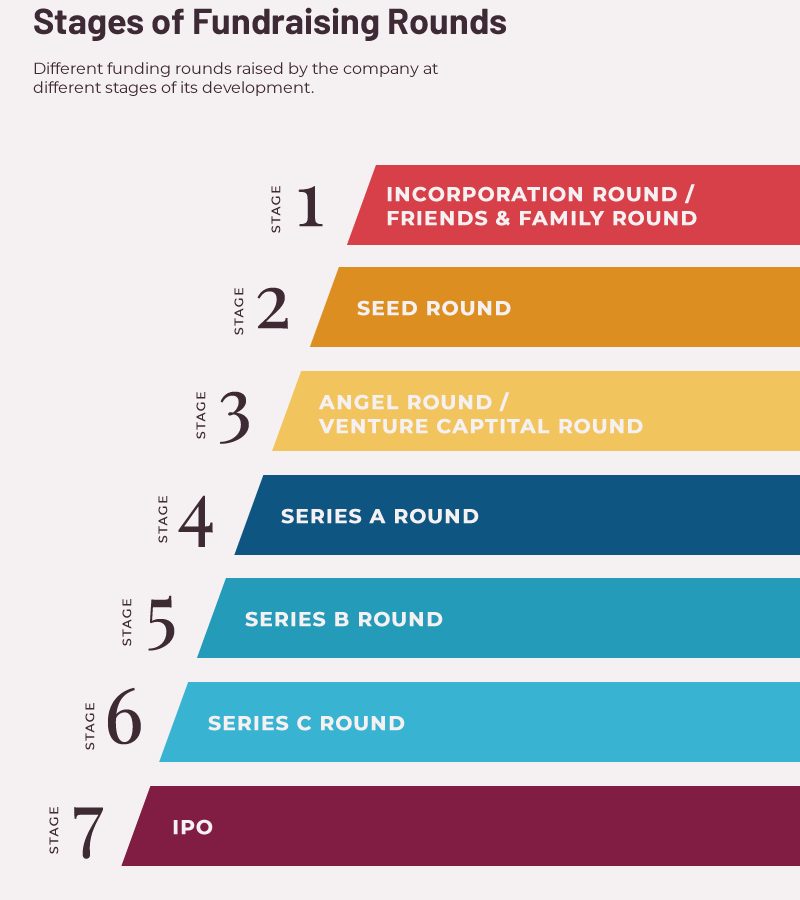

This article will walk you through the different funding rounds raised by the company at different stages of its development.

1. Incorporation Round/Friends and Family Round

This is the first stage when the capital is infused into the company. At this stage, the company is still at its inception and ideation stage trying to establish itself. Capital is mainly required to set up the company, build a prototype model of the business/product and establish operations.

The capital required at this stage is relatively low. Typically, the founders or their family, friends invest in the company

2. Seed Round

This is the first of the funding round where the capital is invested by an outside investor. The capital is mainly required to progress to the next developmental stage. This stage mainly involves funds required to meet working capital needs, gain market and customers, conduct research etc. Companies approach seed investors, incubators among others to bring in the capital.

3. Angel Round/Venture capital round

The company is fairly established now and is showing a consistent sign of growth. At this stage, the capital is mainly required for expanding operations, entering into new markets, product development etc. For this, companies approach Angel investors, Venture capitalists to seek funds in addition to seeking the necessary expertise and networking required to take the company to its next growth phase.

4. Series A round

- Understand the risk exposure in investing in the company;

- Check if the business is in confirmation with the statutory laws;

- Identify any loopholes that could cause drastic damage to the business in the future;

- Assess the value of the company, its assets, intellectual property;

- Examine if the facts represented to them are true, factual and compliant with the investment criteria;

- Ensure that the investment does not exceed the FDI sectoral caps and so on.

5. Series B

Most companies stop raising funds after Series A rounds. However, if the company has more potential for growth and wishes to venture into international markets and target new customers, it raises a Series B round. At this stage, the value of the company is high, the volume of funding and the risk associated with it is also high. Typically, investors funding at this stage ask for a high equity stake for funding the round.

6. Series C

In this stage, the company is highly successful and has acquired full market penetration. Funding is mainly required if the company wants to enter into new business lines and scale up its operations exponentially.

7. IPO

This is the stage where the company has gone public. The companies at this stage are already well heard of and have a huge traction in the market. Companies issue shares to the public to raise funds. The market forces determine the price of shares.

All funding rounds are governed by terms that bind the parties of the investment deal. These terms impact the cap table in different forms. Use our equity management tool Hissa to run different scenarios of a funding round to understand the pre and post shareholding. You can decide the terms of the round accordingly.