Investors fund companies with a goal to earn higher return on their investments. This happens when the company grows and the value of the company goes up. However, this is not always the case especially with start ups. For many practical reasons, the company’s value may drop and it is always best to be prepared for such events. This is why investors insist on having an anti-dilution clause in the term sheet to protect themselves from a drop in the price per share which is popularly called down round.

Theoretically adjustments in price under anti-dilution is possible for both equity and convertible. However, owing to tax and foreign direct investment considerations, realistically, this works only in respect of convertible securities such as convertible preference shares subject to conditions.

This article provides an overview on the importance of having an anti-dilution clause in the definitive agreements and how it protects your ownership stake in the company.

Before we get into what anti-dilution means, let us understand dilution.

What is Dilution?

Whenever a company raises a new round of financing, the new shares issued eat into the equity holding of the existing shareholders resulting in a dilution.

For example, if a shareholder is currently holding 400 shares in a company with a total outstanding shares of 1000, the investor’s shareholding is 40% (400/1000*100). If the company issues 1,000 shares in a new round, with the shareholder continuing to hold 400 shares, then his shareholding will go down to 20%(400/2000*100).

This dip in the shareholding percentage will not impact adversely if there is a corresponding increase in the value of the company and the share prices go up. However, a reduction in the value impacts the shareholder’s return negatively.

Down round and shareholders’ equity

In any future round, if the company issues shares at a price lesser than the price originally paid by the investors in the previous round for the same class of shares, it results in a dilutive issuance of additional equity shares to the new investors which is unfair to the existing shareholders. For example, if a Seed investor has received 100,000 CCPS shares at Rs.50 per share, for an investment of Rs.5,000,000 in the Seed round and the price of the shares falls to Rs.25 in the subsequent Series A round, then a Series A investor would receive 200,000 CCPS shares for the same 5,000,000 amount of investment.

To reduce such a risk of dilution, if the shareholders are insured under the anti-dilution clause they can enforce their right to maintain capital.

What are the methods of Anti-dilution?

There are three methods of anti-dilution – (a) Broad based weighted average, (b) Narrow based weighted average and (c) Full Ratchet.

1. Under broad based weighted average, the investors’ price per share is reduced based on the weighted average price of the new issuance and all capital instruments against which capital has been raised till date. This includes all equity shares, preference shares, warrants, options and other convertible instruments assuming that they have been converted to equity.

2. Under narrow based weighted average, the investors’ price per share is reduced based on the weighted average price of the new issuance taking into consideration only the preferred shares in respect of which the anti-dilution protection is available resulting in a higher average than the average derived under the broad based weighted average method.

3. In full ratchet, the conversion price is adjusted down to match the issuance price of shares in the new round.

How does the Anti-Dilution Protection clause work?

The anti-dilution clause protects the value of the shareholders in a dilutive issuance, compensating them on the basis of the adjusted price per share.

Let’s look at an example :

Company Webb Private Limited was incorporated by founders with 750000 amount invested by the founders of the company. The price per share at the time of incorporation was INR 10.

seed round

As the company grew, it raised an additional Round- Seed Round. The new investor of the round- seed investor negotiated the anti-dilution protection clause as part of the shareholders agreement for this round.

The cap table post the seed round was:

| Investor | Original Investment | Price per share | No of Shares | % Holding |

| Founders | 750000 | 10 | 75000 | 75% |

| Seed | 250000 | 10 | 25000 | 25% |

| Total | 100000 | 100 |

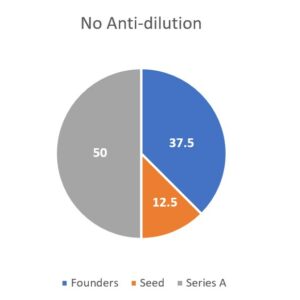

series a - No Anti-dilution

Unstable market conditions led to the company’s value falling and a corresponding decrease in its price per share from INR 10 to INR 5.

The cap table post the downround looked like:

| Investor | Original Investment | Current value of investment | Price per share | No of Shares | % Holding |

| Founders | 750000 | 375000 | 5 | 75000 | 37.5 |

| Seed | 250000 | 125000 | 5 | 25000 | 12.5 |

| Series A | 500000 | 500000 | 5 | 100000 | 50 |

| Total | 200000 | 100 |

Since series A round was a down round, seed investor applied the anti-dilution clause to reduce the hit on her shareholding in the company.

Cap tables under full ratchet and broad based weighted average looked as follows:

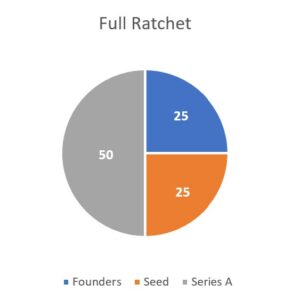

full ratchet

AS = (RAS x RSP/NIP) – RAS

For the purpose of this clause,

‘AS’ is the aggregate number of additional shares to be issued to the ratchet holder;

‘RSP’ is the old conversion price;

‘NIP’ is the issue price of the new dilutive issuance;

‘RAS’ is the aggregate number of shares held by the ratchet holder;

Additional shares to be issued (AS) = (RAS x RSP/NIP) – RAS

=25000*(10/3.33)-25000

= 50000

Accordingly, seed investor was entitled to receive 50000 shares.

| Investor | Original Investment | Current value of investment | Anti-dilution additional shares issued | Price per share | No of shares | % Holding |

| Founders | 750000 | 340909 | 3.33 | 75000 | 25 | |

| Seed | 250000 | 159090 | 50000 | 3.33 | 75000 | 25 |

| Series A | 500000 | 500000 | 3.33 | 150001 | 50 | |

| Total | 300001 | 100 |

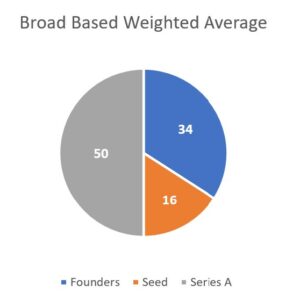

Weighted Average Anti- Dilution Protection:

CP2 = CP1 *(A+B)/(A+C)

“CP2” is the adjusted price per share

“CP1” is the previous round price per share

“A” is total Pre-money shares;

“B” is New Money / Previous round price per share;

“C” is the new number of equity shares issuable in the new round.

= 10* (100000+50000)/(100000+110000)

= 7.14

Conversion ratio= Original price per share/Adjusted Price per share

= 10/7.14

= 1.4

Total shares seed investor holds at the end of Series A round= (Number of shares the investor holds as on date*Conversion ratio)

= (25000*1.4)

= 35000

Additional number of shares to be issued to the seed investor= Total shares seed investor holds at the end of Series A round- Total number of shares held previously

= 35000-25000

= 10000

Total number of shares held by the Founder and Seed investor at the end of Series A round= 75000+35000

= 110000

New price per share= Pre money amount/Total shares held by Founder and Seed investor at the end of Series A round

= 500000/110000

= 4.54

Current value of investment= Number of shares held by the investor after Series A round* Series A price per share

Founders= 75000*4.54= 340500

Seed Investors= 35000*4.54= 158900

Series A investors= 110000*4.54= 499400

| Investor | Original Investment | Current value of investment | Anti-dilution additional shares issued | Price per share | No of shares | % Holding |

| Founders | 750000 | 340500 | 4.54 | 75000 | 34 | |

| Seed | 250000 | 158900 | 10000 | 4.54 | 35000 | 16 |

| Series A | 500000 | 499400 | 4.54 | 110000 | 50 | |

| Total | 2,20,000 | 100 |

Comparative snapshot :

As seen, the anti-dilution clause protects the existing shareholders helping them maintain their shareholding in the company. Of the three methods mentioned above, full ratchet is the most investor friendly and the broad based weighted average is the most common equity holder friendly.

Exceptions to the anti-dilution clause

There are certain exceptions to the anti-dilution clause. No adjustments would be required under the following scenarios:

- Issuance of stock options to employees

- Issuances to strategic partners approved by the investor where issuances are for a lesser price but anti-dilution is waived,

- Issuances pursuant to conversion of outstanding warrants and other convertible instruments,

- Equity shares issued pursuant to a stock split or similar reorganization,

- Securities issued in connection with any bona fide business acquisition by the company or an IPO.

Any change in the conversion price of shares, should be notified by the company to the shareholders issuing a notice as approved by the Board stating that the adjusted price under anti-dilution shall be considered as the conversion price for any subsequent exercise of ‘Valuation Protection Right’.

It never hurts to be prepared. The anti-dilution clause built into the term sheet and other definitive agreements provide a guarantee to the shareholders and acts as a safety net to minimize dilution of their shareholding in the company